income tax rates 2022 ireland

Income tax rates will stay the same at 20 and 40 but there will be increases to tax credits and changes to the income tax bands. If the corporation distributes those earnings as a dividend the income is taxed again at the individual level at a top dividend rate of 26 percent resulting in 1976 in dividend.

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

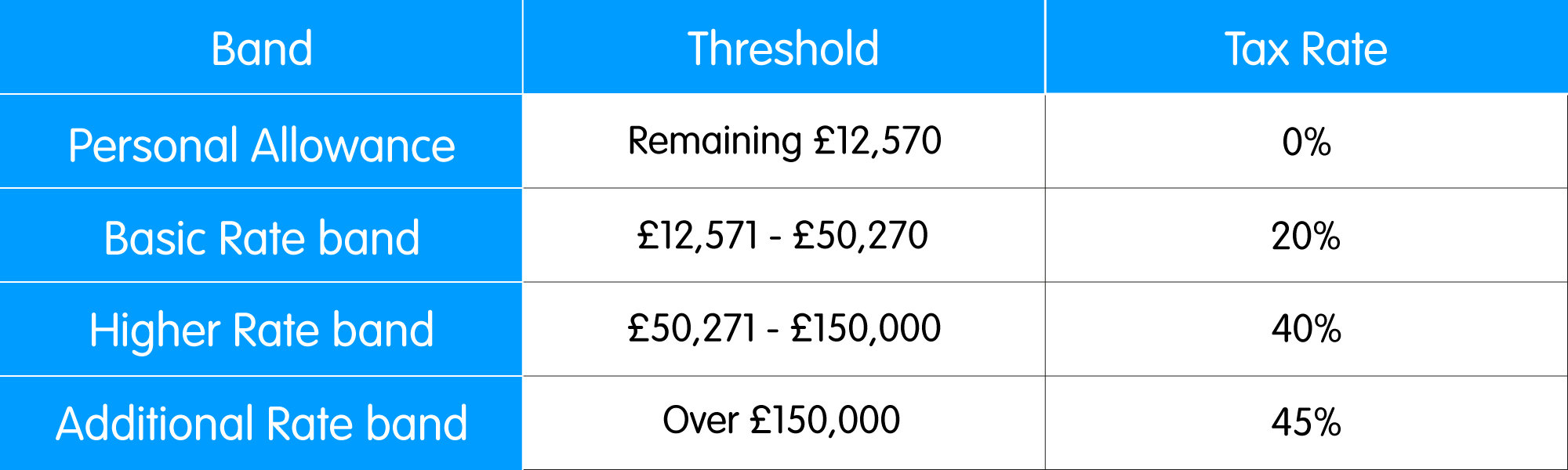

The rates of 20 and 40 will remain as they are but the standard tax rate band ie the amount you earn before paying the.

. If you qualify for the Single Person Child Carer Credit your standard rate band increases by 4000 to 39300. In 2022 for a single person with an income of 25000 the effective tax rate will be 120 rising to 198 at an income of 40000 and 404 at an income of 120000. Married or in a civil partnership one spouse or civil partner with income 45800 20 balance 40.

State Pension increased 5. 44300 20 balance 40. The weekly income threshold for the higher PRSI rate will also rise from 398 to 410.

43550 20 balance 40. Non-trading passive income includes dividends from companies tax resident outside Ireland with some exceptions interest rents and royalties. Ireland Personal Income Tax Rate was 48 in 2022.

This means that the first 35300 of your income is taxed at 20 and anything above that is taxed at 40. By Doug Connolly MNE Tax. Irelands 2022 property tax deadline just days.

The Income tax rates and personal allowances in Ireland are updated annually with new tax tables published for Resident and Non-resident taxpayers. The Tax tables below include the tax rates t. Standard rate band increased by 1500.

Balance of income over 73600. The standard rate tax band the amount you can earn before you start to pay the higher rate of tax will be increased by 1500. Ireland has a bracketed income tax system with two income tax brackets ranging from a low of 2000 for those earning under 36400 to a high of 4100 for those earning more then 36400 a year.

Employee tax credit tax credit increase from 1650 to 1700. Budget 2022 announced 12 October 2021 features a total budgetary package of 47bn split between expenditure measures worth 42bn and tax measures worth 05bn. Tax Bracket yearly earnings Tax Rate 0 - 36400.

Earned income tax credit increase from 1650 to 1700. Heres all the new changes that will affect you in 2022. Married or in a civil partnership both spouses or civil partners with income.

Two incomes of at least EUR 27800 each Income up to 73600. Legislation provides that certain dividend income eg. Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting facilities 9 Flat rate for unregistered farmers rate decreased 55 Cash receipts basis threshold 2m 9 rate applying to hospitality and tourism sector extended to 31 August 2022 Dividend.

Balance of income over 45800. Income up to 36800. Ireland Income Tax Brackets.

The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line with last weeks OECD tax agreement. The following tax credits will increase by 50. The standard rate band for a person who is single or widowed is 35300.

Personal Income Tax Rate in Ireland is expected to reach 4800 percent by the end of 2020 according to Trading Economics global macro models and analysts expectations. Individuals aged under 70 who hold a full medical card whose aggregate income for the year is 60000 or less. 44300 20 balance 40.

Single and widowed person. Use our interactive income tax calculator to estimate your tax position for the coming year in light of the measures announced in Budget 2022. USC Band 2 increased from 20687 to 21295.

25 also applies to income from a business. Ireland Personal Income Tax Rate - values historical data and charts - was last updated on May of 2022. Income up to 45800.

Income from foreign trades is taxed at 125 see the Income determination section. In short the government has increased all standard tax-rate bands by 1500. Balance of income over 36800.

Aggregate income for USC purposes does. This money has been accredited to changes to income tax bands that will enable two-thirds of workers to take home more of their pay. Aggregate income for the year is 60000 or less.

2021 Rate 2022 Rate Income up to 05 Income up to 05 Income above 20 Income above 20 Note 1. United Arab Emirates 1605 GDP YoY Forecast. The Budget 2022 package includes approximate 520m in tax cuts.

The Ireland Income Tax Calculator uses income tax rates from the following tax years 2022 is simply the default year for this tax calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Ireland Annual Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to. Tax-rate band increases. 44300 20 balance 40.

As a result of this change fewer people on incomes around the average wage will be subject to the 40 per cent rate of income tax. Ireland Personal Income Tax Rate was 48 in 2022. The budget also includes expanded relief for start-up companies a new tax credit for the digital gaming sector and planned anti-tax avoidance rules.

The higher rate ie. 2022 EUR Tax at 20. Some of the tax measures include modest changes to income tax rate bands and credits various supports for business as well as measures focused on.

Ireland Income Tax Brackets.

Comparing Irish Income Taxation Rates With Other Eu Member States Public Policy

Chart That Tells A Story Average Income Tax Rates Financial Times

Preparing For The Tax Year 2022 23 Paystream

Effective Income Tax Rates After Budget 2021 Social Justice Ireland

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

2022 Tax Inflation Adjustments Released By Irs

Chart That Tells A Story Income Tax Rates Financial Times

Effective Tax Rates After Budget 2022 And Why Ireland Remains A Low Tax Country Social Justice Ireland

Paying Tax In Ireland What You Need To Know

120 000 After Tax Ie Breakdown May 2022 Incomeaftertax Com

Effective Tax Rates After Budget 2022 And Why Ireland Remains A Low Tax Country Social Justice Ireland

How To Calculate Foreigner S Income Tax In China China Admissions

2019 20 Tax Rates And Allowances Boox

Budget 2022 Main Points What S In It For You

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Chart That Tells A Story Income Tax Rates Financial Times